Dubai Monetary Companies Authority (DFSA) – The primary regulator for monetary services within the Dubai Worldwide Financial Centre (DIFC). Fintech companies are required to obtain a license from both the Dubai Financial Services Authority (DFSA) or Abu Dhabi World https://www.abudhabicityguide.com/features/12829/uae-company-registration.-step-by-step-guide Markets (ADGM) depending on their operational base. These steps create a powerful foundation and help guarantee a easy setup process in Dubai’s thriving fintech ecosystem. That’s not nearly staying on the right aspect of the regulation; it’s the inspiration for trust, development, and investor confidence.

You can validate your business model with out the total regulatory burden of a everlasting license. Assume of the ITL as a regulatory sandbox—a controlled setting where you presumably can take a look at products earlier than committing to full authorization. Companies can function for up to two years with actual prospects and real cash, although with restrictions on scale. The capital requirements are lower than full licenses, usually AED 500,000 to AED 2 million depending on actions. These expenses usually catch entrepreneurs off-guard however are essential for profitable operations.

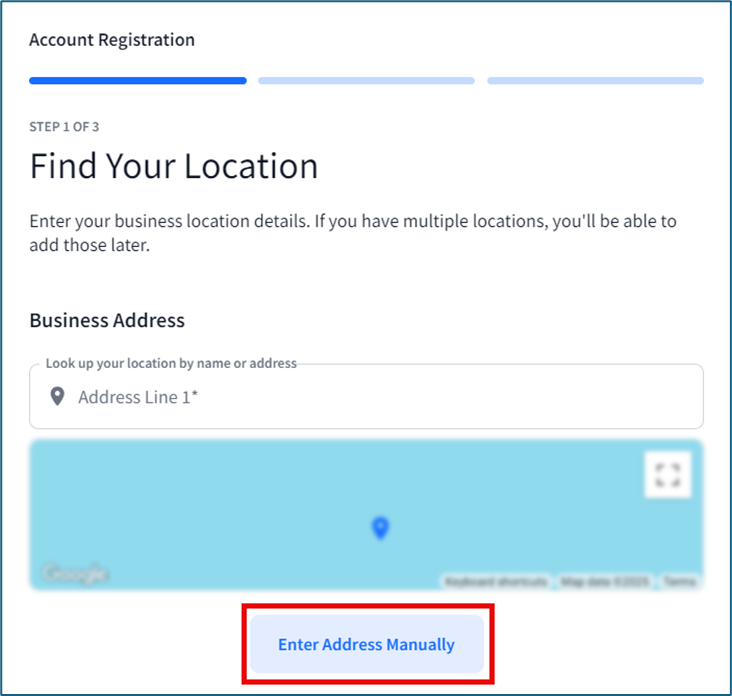

Plan a advertising and go-to-market technique that clearly communicates your distinctive selling points, and be ready to put money into partnerships and customer schooling. Apply for your fintech license via your chosen jurisdiction. DIFC and ADGM each have streamlined processes for fintech startups, with sandbox options if you’re testing progressive models. Some enterprise activities (like funds or crowdfunding) might have extra approval from the UAE Central Financial Institution or Securities and Commodities Authority.

Favorable Tax Regime

This year’s theme, “Fintech for All,” placed emphasis on inclusion and accessibility, while highlighting the sectors set for speedy progress. Digital payments stay the strongest phase, whereas embedded finance, integrating financial providers into everyday platforms is fast turning into mainstream. Islamic fintech also stood out, with discussions focused on delivering Sharia-compliant solutions to faucet into one of the world’s largest underserved markets.

Step-by-step Guide To Launching A Fintech Firm In Dubai

- Understanding this context helps clarify the regulatory proactivity and funding flowing into the sector.

- You will go on to apply to the related financial authority (DIFC, ADGM, or mainland authorities) with the required documents.

- This meticulous chain of verification is what proves to the Dubai authorities that your corporate paperwork is real.

- Right Now, the UAE fintech market is valued at $46.67 billion in 2025, exhibiting how shortly the sector is rising.

- It’s an train in technique, legal precision, and regulatory foresight.

The emirate’s strategic position between East and West, combined with world-class infrastructure and regulatory support, creates an ideal environment for financial technology corporations. Beginning a FinTech firm in Dubai represents one of the lucrative alternatives in today’s digital economy. With the UAE’s progressive regulatory framework, strategic location, and authorities backing for financial innovation, Dubai has emerged because the Middle East’s premier FinTech hub.

This is whenever you uncover the gaps between “we designed it to do X” and “it really does Y.” The first few weeks involve decisions that may haunt you for years should you get them incorrect. How much capital do you really need—not the minimal, however what you’ll really burn through? These aren’t questions you probably can answer by studying regulator websites.

Analysis paralysis costs opportunities, and the fintech firms launching in Dubai today will be tomorrow’s industry leaders. The Dubai Fintech Summit 2025, held on May at Madinat Jumeirah, offered a transparent window into the place the industry is heading. With hundreds of business leaders, buyers, and policymakers from over a hundred and twenty international locations in attendance, the summit strengthened Dubai’s position as a world hub for fintech innovation. Starting a fintech firm in Dubai means following a clear course of. Even a small error can set you again for months, so consideration to detail is essential.

Business Setup In Abu Dhabi For Uk Investors: Course Of, Costs & Free Zone Options

Others, looking to start with their expansion plans to the EU in 2026 despite not having the flexibility to benefit from the transitional period, shall be within the place to leverage a clearer regulatory panorama in any respect levels. Subsequently, some consolidation out there is highly probably, which will inevitably result in clear differentiation between the fintech firms that can stand out in today’s surroundings and others. The regulatory update is anticipated to assist further development in DIFC’s digital property sector, which could result in elevated hiring throughout compliance, authorized, know-how, threat, operations and product roles. For firms, the principles provide a clearer construction for activities corresponding to buying and selling, asset and fund management, custody, advisory providers and different crypto-related financial companies. The UAE’s 2025 legislative overhaul marks a decisive step towards creating a modern, resilient, and globally competitive authorized framework. These reforms kind part of a broader technique to strengthen financial integrity, embrace technological innovation, and embed sustainability at the core of financial activity.

1 Relevant Regulator And Course Of Overview

Incubators similar to In5 Tech and Startupbootcamp FinTech also present workspace, enterprise support, and introductions to a group of like-minded founders. Fintech corporations in Dubai should have robust anti-money laundering (AML) and know-your-customer (KYC) protocols. This means putting systems in place to identify and confirm all clients, monitor transactions, and report suspicious exercise. Regulators will review your AML policies through the licensing stage, and you’ll be anticipated to update your procedures as dangers change. Getting your fintech license in Dubai sets the inspiration for every thing that follows. Get it mistaken, and you’ll face delays and even rejection—so concentrate on precision and compliance from the start.